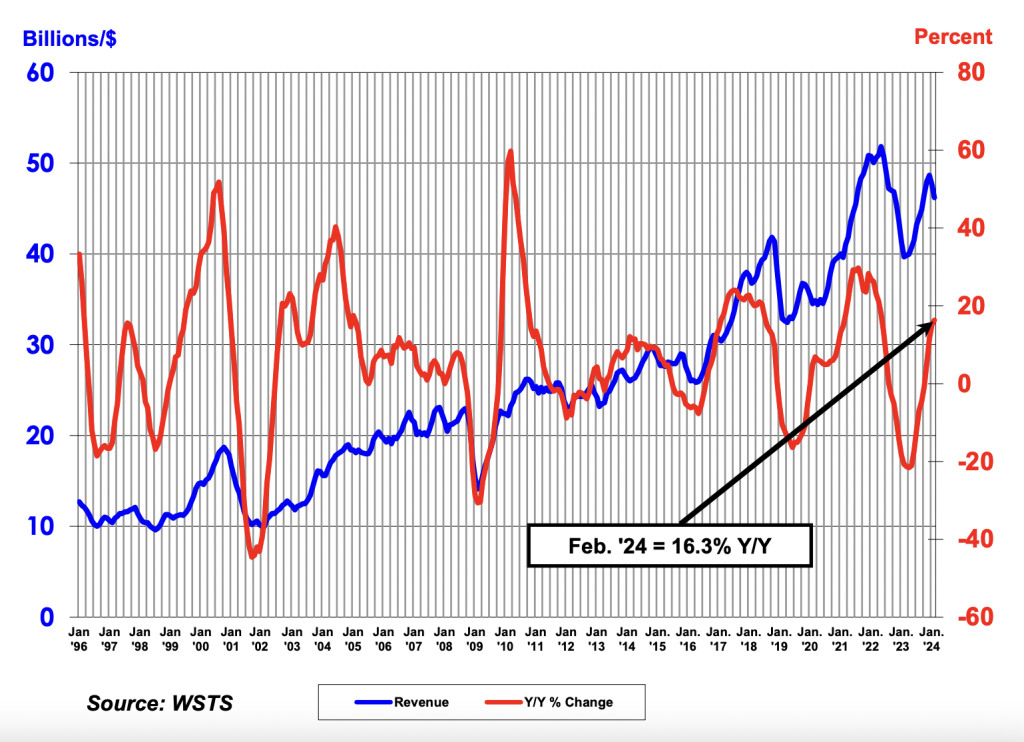

The Semiconductor Industry Association announced in early April that global semiconductor sales totaled $46.2 billion in February 2024. That’s an increase of 16.3% compared to the February 2023 total of $39.7 billion.

That growth includes year-over-year gains in the Americas of 22% and in China (28.8%).

“[This is a] continuation of the strong year-to-year growth the market has experienced since the middle of last year,” said John Neuffer, SIA president and CEO. “Sales in February increased on a year-to-year basis by the largest percentage since May 2022, and market growth is projected to persist during the remainder of the year.”

So, what does that mean for manufacturers using (or even considering) induction heating equipment?

The second half of 2023 into Q1 2024 has seen a spike in demand for semiconductor products, spurred mostly by growth in AI, automotive and industrial markets.

For example, the association forecasts even greater growth to come via the automotive space in coming years.

“The automotive industry will continue to be an important sector propelling semiconductor demand through the decade,” according to the organization. “Innovation in vehicle electrification, autonomy, and connectivity requires greater chip content in vehicles. The current generation of cars, including EVs, can have between 1,000 – 3,500 semiconductors. This number is expected to grow as consumers continue to prioritize advancements in vehicle safety systems, vehicle connectivity, and electrification when choosing a car.”

Those semiconductors are powered by silicon or diamond wafers that can be created by induction heating technology.

For those manufacturers growing crystals for semiconductors or even developing semiconductors outright, induction heating equipment can provide an efficient solution for that increasing demand. With lower costs (in terms of both time and finances), businesses can lean into that market growth and increase their own top-line revenue opportunities.

Given that growth, timely output is important. Induction heating equipment heats (and cools) materials much more quickly than traditional heating methods, such as furnaces. This means greater throughput for manufacturers. It’s important to keep that basic concept in mind when integrating any new induction heating technology into existing manufacturing equipment.

For instance, the design of any induction heating system must incorporate continuous operation and integrate with any automated process control systems already in place.

Silicon continues to be the dominant substrate for semiconductor wafer development. This is primarily due to silicon’s excellent semiconducting properties and its abundance as an element on Earth’s crust (it’s the second-most abundant element after oxygen).

Induction heating equipment can generate crystals in hot crucibles in two ways: the Czochralski Process and the Float Zone Process. Those processes offer different degrees of efficiency when considering that high throughput for semiconductor manufacturing needs.

But diamonds represent a compelling opportunity, too, even though the material cost may be outsized for now in 2024.

Diamond has the highest thermal conductivity of any material, much greater than silicon. The net result is that diamond can dissipate heat more efficiently. That efficiency is vital when discussing the global demand in the semiconductor market.

Because of diamond’s unique properties, the precision of crystal growth is of the utmost importance. Even longtime crystal growth manufacturers will need to revisit protocols if they make the switch from silicon material to diamond; consider new temperature profiles, controlled atmospheres, or specific coil designs to achieve desired outcomes.

Manufacturers should keep an eye on broader market trends too, even beyond the semiconductor space.

A general, global push for more sustainable business operations will likely have an effect on the semiconductor market, and manufacturers working with induction heating equipment may be uniquely positioned to develop systems that can yield a smaller carbon footprint. This advantage could prove meaningful as the industry continues to evolve.